Premium Invoice Factoring Since 1969

Discover The Riviera Difference

- Non-Recourse Factoring

- Top-Rated Customer Service

- Up to 95% Advance

- No Monthly Minimum

- No Hidden Fees

- 24/7 Live Support

Ready to Get Started?

Riviera Gets You Paid FAST

- Set-up as quick as 48 hours

- Dedicated support teams

- Fuel discount cards available

- Non-recourse funding. We take the credit risk

Manufacturing Factoring & The CHIPS Act

Invoice financing for manufacturers uses unpaid invoices as collateral to access immediate cash flow. You submit your outstanding invoices to a factoring company, which gives you an advance on the value of your unpaid invoices. You put your money to work immediately while the factoring company works with your customer to settle the invoice according to the original payment terms.

CHIPS Act funding is a real opportunity for smaller companies in the tech sector to grow as they contribute to national security and America’s position as a leader in the semiconductor market. As funding is expected to conclude by the end of the calendar year, applicants need to move quickly.

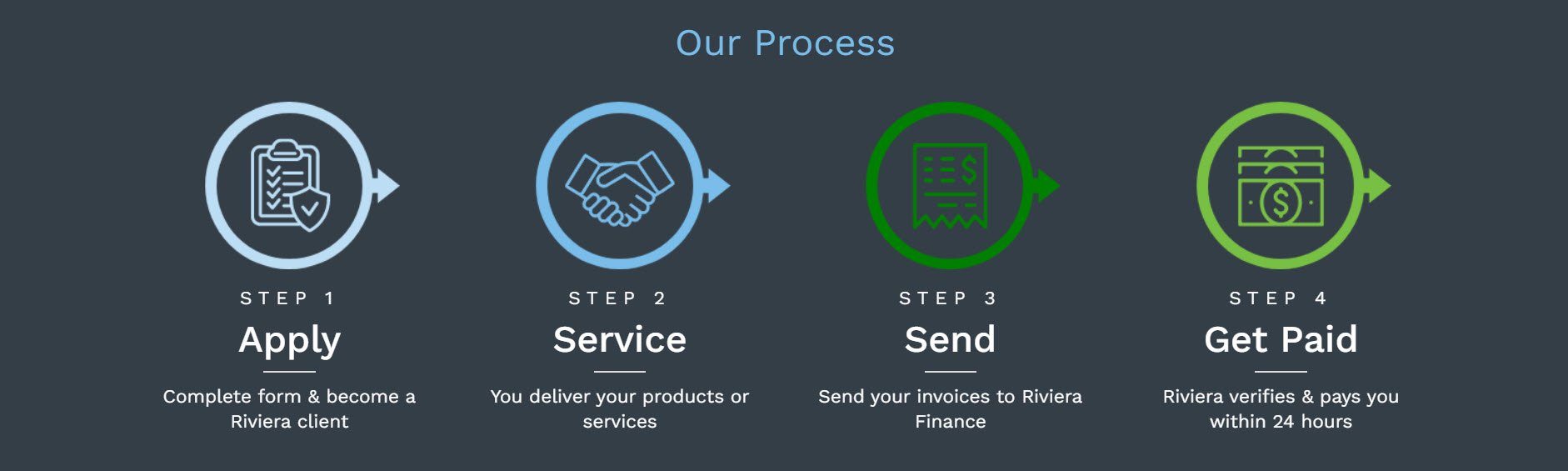

How Invoice Factoring Works

Invoice factoring gives businesses the power to ensure growth without incurring debt. Clients are funded within 24 hours after invoices are submitted and verified by Riviera.

2. You Deliver Your Product or Service As Usual

3. You Send Your Invoice Directly to Riviera Finance

4. We Verify the Product Was Received or Service Performed

5. You Receive Cash from Riviera Within 24 Hours

6. Your Customers Pay Us Directly

About Riviera Finance

Founded in 1969, Riviera Finance is nationally recognized as a leader in business financing and a top invoice factoring company. Riviera Finance provides full-service, non-recourse invoice factoring to growing companies.

We are the experts in invoice factoring and accounts receivable management. Riviera Finance maintains offices throughout North America to provide face-to-face service and expert financial solutions to small and medium-sized businesses. Currently serving more than 1,400 clients, Riviera holds an excellent credit rating, has shown consistent, positive earnings, and maintains a diversified capital base.

More Than 25 Invoice Factoring Locations

Companies across the United States and Canada depend on Riviera Finance to deliver reliable local service to support their daily cash flow needs. Wherever you are, we have an invoice factoring company office with experienced professionals to serve you.

.png?width=249&height=65&name=logo-2%20(1).png)